Fraud by any other name

It’s not illegal if you lie to yourself as well, right guys?

This idea has been simmering for some time to be sure, as I continue to look onward at the veritable dumpster fire we call ‘tech’ today. But just recently I got wind of the bankruptcy of the company behind Instant Pot, off the heels of the so-called ‘venture capitalist’ mobster scum, and I figure now’s the time to go ahead and crank this out. It’s not like I have half a dozen other drafts waiting to be penned.

It’s time to write this because finally, the issue has become legible enough that I can make the case I’ve known for a while now needs to be made about these vultures: their actions are commensurate by consequence with fraud.

So let’s just jump into it, shall we?

There is a big contagion going around lately, and I’m not talking about the latest strand of coronavirus. Ground zero for this contagion is the tech industry, and it has spread to the rest of the American economy through tech’s shotgun marriage to finance, the animus of our economic system since before 1929. There is a perennial temptation for inadequate people thrust into powerful positions to defraud the public out of denial and embarrassment of their lack of merit. The most classically famous example of this was the scheme of Charles Ponzi, pioneer and namesake of the Ponzi scheme.

Contemporaneously, we have seen much rehashing of the fundamentals of fraud in the context of the cryptocurrency business. A lot of people are being served cold, prison-beckoned reminders of the definitions of things like criminal intent, fiduciary duty, and the basics of securities law in developed nations. But this problem is not confined to the farcical industry calling itself ‘crypto’; far from this, it actually percolates into the entire economy to some extent or another. Two days ago, the most succinct proof of this landed on the laps of investors and newsgoers alike: the bankruptcy of Instant Pot. The American paper of record trumpets thusly:

Although the Times reveals the reason for their failure, namely an unresolvable debt burden, they neglect to reveal the nature of how that came to be. Fortunately, the Atlantic is a bit more honest:

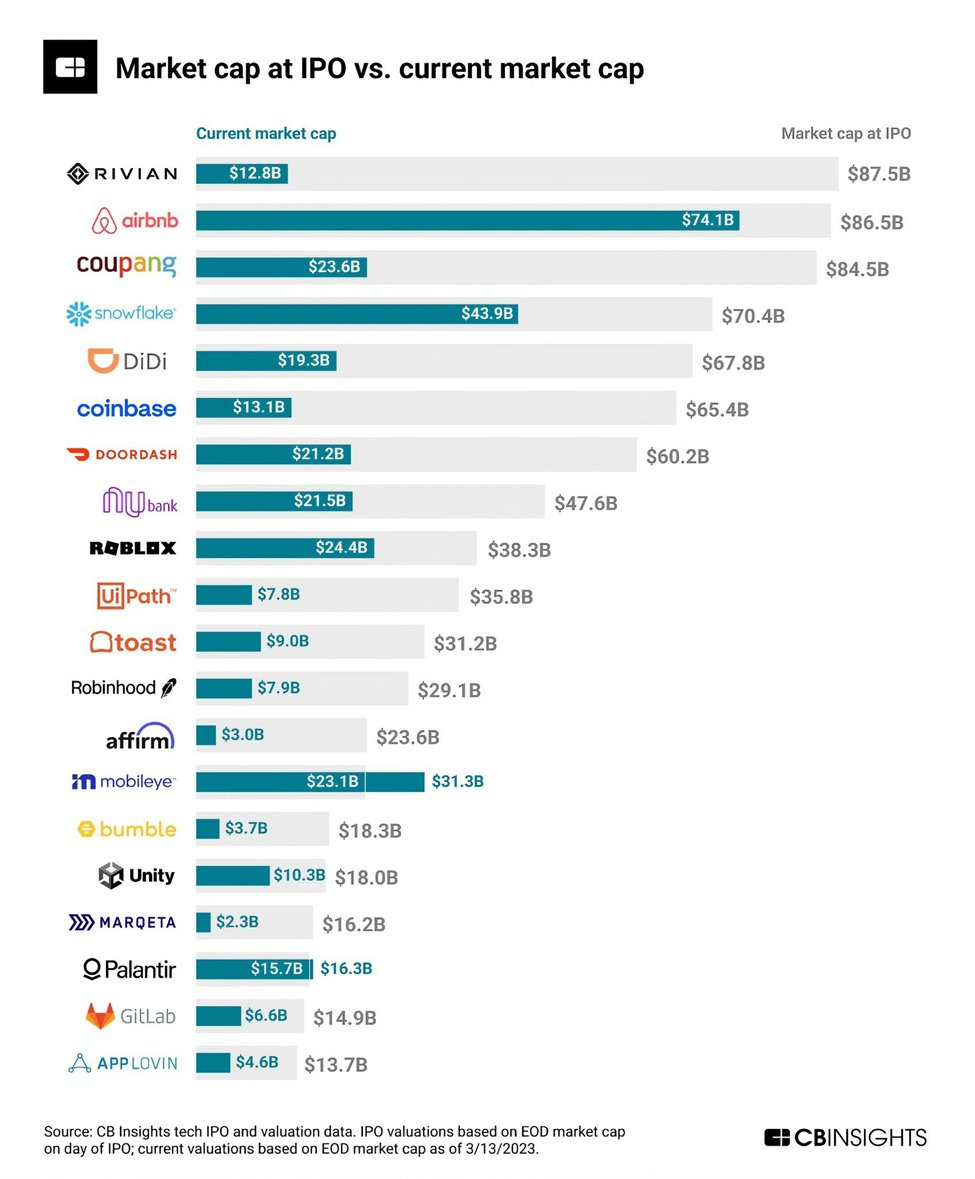

Huh. Cornell Capital, you say, bought them out? At a cartoonish valuation, in the famous mania-driven style of dotcom mobsters? And then to everyone’s shock and surprise, the company joined the ranks of hollow husks worth a tiny fraction of what they once were? How could that be? Where have we seen this before?

You know, for not having any of the hallmarks of a wilful fraud, this sure does have the perfect outcome if fraud was the goal. Not only is the outcome identical, the rationalisations for that outcome line up well with a fraudster’s: blame the victim for not knowing any better. With ‘crypto’, ‘AI’, and maybe the next big ‘current thing’ of quantum computing, the standard line seems to be whatever tech stakeholders wanted to do is fine anyway, and it’s everyone else’s fault for not knowing any better. When artists complain about their social concerns, they’re lambasted and ridiculed. It’s always the same psychopathic song and dance.

The scene here is well-treaded enough from the outside like that, so let me try to evaluate these snobs more on their own terms, since I am both better equipped to do so, and of the mind that it is the only way to fully discredit them and bury them into the history books alongside our old friend Charles Ponzi where they belong. My example for this is the con man and expired programmer known as George Hotz, of recent infamy for working a two-month do-nothing stint at Elon’s Twitter, and for raising funding for a nonexistent company based on an awful business idea over Discord no less.

I can think of no better example of a legitimated career huckster than George Hotz. His Wikipedia article at the time of writing clocks in no less than 81 references, many from such star-spangled regime-approved mags as The Verge, the New York Times, CNBC, and Bloomberg.

From his first exploits on the world stage at the ripe age of seventeen, George is seen going straight for the goods in pioneering the kinds of exploits that would earn him headlines. After two-and-a-half years of hacking whatever aspects of the iPhone would net him the most cred, he announced he would be abandoning his iPhone work, vaguely citing “demotivation over the technology and the unwanted personal attention”. Funnily enough, Wikipedia juxtaposes this quote over a picture of him proudly hoisting up a hacking gadget at a TechCrunch conference in 2016. We can be sure this was disingenuous as we read on, because the next thing he would turn his attention to is something that would lead to him getting court-ordered out of the scene. That scene would be Sony game hacking.

I sympathise more and more with the old guard of the Nintendo hacking scene as time goes on, because I understand better what they have always known and warned against: hacking motivated by self-aggrandisement and ego ruins scenes. They sounded the alarm about Team Xecuter long before anyone else knew, and those people are in prison now. Guess George got lucky with Sony.

After he settled out of court with them, he went to work for Zuckerberg for just over a year’s time, leveraging his celebrity status at this point to make big FAANG bank before it was cool, no doubt as an untouchable baron in the company. There’s not much information on what he was up to in 2013, but in ‘14 he would make another foray into clout-driven mobile hacking, this time with Android, where he released one (1) root exploit and rode the notoriety from it into the ground. After that, he created Comma.ai, his gamble on startups, which were getting really hot around 2015.

Reading about Comma on his page is quite amusing, because it passively illuminates how much of a clueless and headstrong dipshit he is. Elon Musk even offers to buy it from him for $15M, minus $1M for every month it takes him to get to MVP. If George was at all what he cracks himself up to be, he would have made that work. Not only did that not work out for him, he even got his ass handed to him by the NHTSA for operating unlicensed transportation equipment on public roads. When confronted about this by the authorities, he proceeded to act like a massive faggot, trotting out the rhetroic Kristen Lee describes as the worst possible, quoted “try and regulate us, thought leaders, and we’ll take our ball and go home.” Man, what an asshole. We should call him George Hotzhit, because he really thinks he’s hot shit. You would think a guy who was all that could manage to sell his company to Elon when he literally had a standing offer from the man himself.

To his credit, George seems to be good at one thing: short bursts of drug-fuelled hackathon-esque marathon coding sessions. When he was wooing Elon to get a job at Twitter, he spent hours on end mindlessly reading the Twitter API docs and poking at their public endpoints, on Twitch of course, because none of this amounts to anything if not for clout. Quite frankly I’m scared to wonder what kind of drug cocktail he was on. I used to be prescribed amphetamines when I was a teenager, and let me tell you, they’re really bad. It’s not worth being up for days on end, if this 33-year-old guy is any testament to how that eventually works out.

I think those hacking sessions are really the most he can legitimately claim credit for, because the goods are on his side in those cases. The iPhone really was hacked, and everyone knows he did it. Unfortunately, his attempts to parlay those instances of overnight notoriety into any kind of culturally substantive long-term relevance have only resulted in embarrassment, failure and denial thereof for him. He’s just not an engineer, or a leader, or a visionary, or anything but a guy who surreptitiously rips apart complex software systems for the express purpose of breaking and exploiting them. He’s the type of guy my theoretical work seeks to make unemployable, sadly. Nobody wants exploitable software, and it’s not a fact of life either – just a consequence of our incomplete understanding of computer science.

George’s most recent escapades with seeking funding for an AI accelerator company he started out of nothing and nowhere last month are really what drives my point home though, and brings it back to my original thesis with this article regarding the nature of fraud and its interplay with intent. Here was his initial pitch that made the rounds on social media, from Discord no less:

And just two weeks later, here’s him reposting emails he sent to AMD, where he is clearly indignant that things are not working out for him because, wouldn’t ya know it, drivers are complicated:

Finally, he ragequits in a GitHub issue comments section with AMD, deflecting the blame from his own incompetency to the opaqueness and alleged instability of their open source driver code. He then gives some unsolicited advice, and closes saying “feel free to close all of my issues,” earning him 65 laughing emoji reactions. Most people are well aware how thoroughly he beclowns himself here:

All in all, it is abundantly clear that George Hotz is stunningly, breathtakingly full of shit. But regardless of that, he still gets the money, and for that I have to beg the question: what difference does it make about ‘fraud’ to the rest of us when con artists get the golden goose anyway? Why doesn’t this guy deserve to be in prison, alongside the likes of Sam Bankman and Bernie Madoff? Is it because he’s not dealing with financial instruments? Is it just a fundamental limit of criminal intent?

To be clear, I don’t have an answer to this, but I would really like people to think on it. I think many people are well aware that something foul is in the water these days, and a public conversation would do much good at resolving what is going so terribly wrong here to enough satisfaction. I think George is a really good starting point for cracking this nut, so to speak, because he has had a well-documented decade-plus long string of failed cons, with no indication at all that he does not believe in his own delusions and is actually a fraudster. This man is so emblematic of tech culture today, a kind of best case of the median tryhard who’s slinging JavaScript into some fake startup that doesn’t even have a business plan. I couldn’t imagine a better starting point for modelling how these outcomes commensurate with fraud issue forth from people who are only subconsciously, at most, intending as such.

I think there is much to be said sociologically about why this happens, namely a dissection of men who want so badly to be ‘great’ despite not having the goods to back it up that they would be willing to lie, cheat and steal. It’s why I brought up Charles Ponzi early in the article. There’s a big connection to be made between him and other textbook criminals, and this more contemporary strain of people who lie to themselves, and therefore everyone else, in misplaced dreams of grandeur. To that end, I doubt this will be the last article I’ll write on the subject.